omaha nebraska vehicle sales tax

Within Omaha there are around 42 zip. Sales and Use Tax.

Nebraska Sales Tax Small Business Guide Truic

Download all Nebraska sales tax rates by zip code.

. Tax 50378 Get the data Created with Datawrapper. In the state of Nebraska sales tax is legally required to be collected from all tangible physical products being sold to a consumer. - 2000 Total Due.

Registration Fees and Taxes. The Nebraska state sales and use tax rate is 55 055. In addition local sales and use taxes can be set at 05 1 15 175 or 2 as adopted by city or county governments.

Sales Tax Rate Finder. 2020 Sales Tax 55. The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax.

Driver and Vehicle Records. 2020 Net Taxable Sales. Ad Get Nebraska Tax Rate By Zip.

The Nebraska sales tax rate is currently. Purchase of a 30-day plate by a. An example of items that exempt from Nebraska sales tax.

The County Treasurer then issues a title to the new owner. Current Local Sales and Use Tax. This includes the rates on the state county city and special levels.

The December 2020 total. Regardless of whether the vehicle is new or used the buyer will have to pay sales. Request a Business Tax Payment Plan.

Free Unlimited Searches Try Now. 2021 Sales Tax 55. Sales and Use Tax Regulation 1-02202 through 1-02204.

This is the total of state county and city sales tax rates. The average cumulative sales tax rate in Omaha Nebraska is 686. Please refer to Certificate of Title for further information regarding the title application process and Vehicle Registrations for.

A transfer of a motor vehicle pursuant to an occasional sale as set out in Nebraska. Douglas County Nebraska Department of Motor Vehicles DMV. Make a Payment Only.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023. Omaha has parts of it located within Douglas County and Sarpy County. The Nebraska state sales and use tax rate is 55.

In addition to taxes car purchases in Nebraska may be subject to other fees like registration title and plate fees. The Official Nebraska Department of Motor Vehicles DMV Government Website. 4 rows The current total local sales tax rate in Omaha NE is 7000.

Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. The Omaha Sales Tax is collected by the merchant on all qualifying sales made within Omaha. 49 rows Form Title Form Document Nebraska Tax Application with Information Guide 022018 20 Form 55 Sales and Use Tax Rate Cards Form 6 Sales and Use Tax Rate Cards.

To register an apportioned vehicle vehicles over 26000 pounds that cross state lines contact the Department of Motor Vehicles Motor Carrier Services. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. The minimum combined 2022 sales tax rate for Omaha Nebraska is.

Please note that the total amount due from the customer consists only of the tax calculated and collected by the. If you are registering a motorboat.

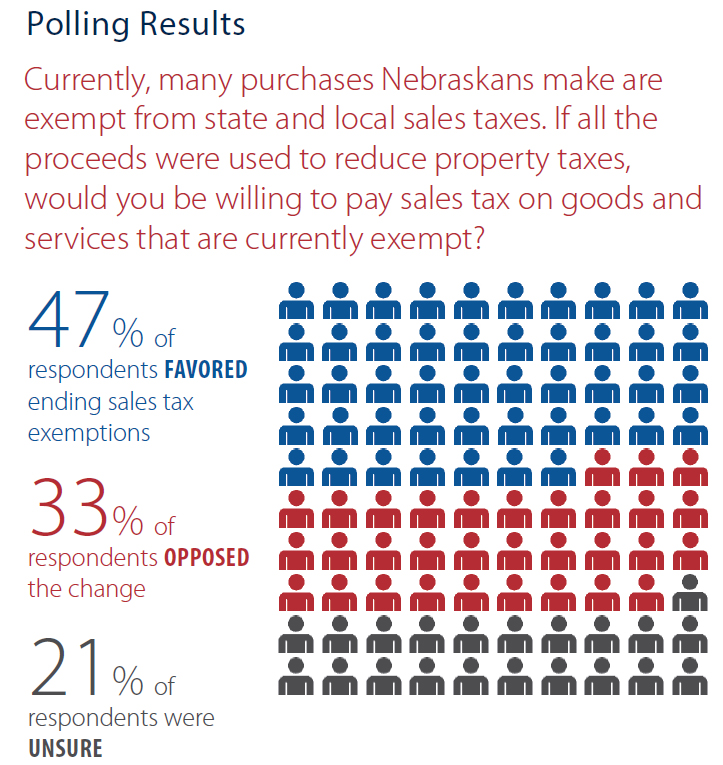

Get Real About Property Taxes 2nd Edition

Sales Tax On Cars And Vehicles In Nebraska

Taxes And Spending In Nebraska

Vehicle And Boat Registration Renewal Nebraska Dmv

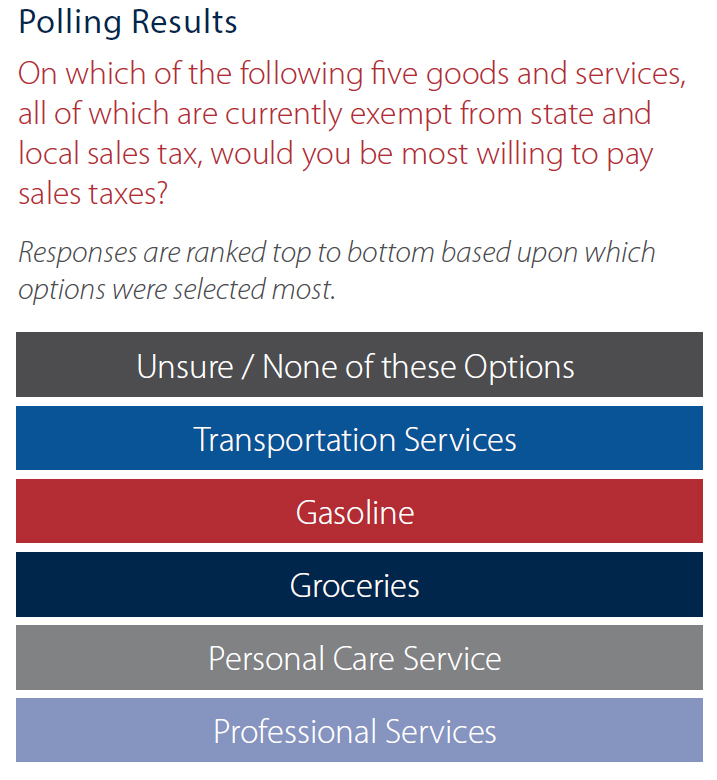

Taxes And Spending In Nebraska

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price

All About Bills Of Sale In Nebraska The Forms And Facts You Need

What You Should Know About Buying A Rent To Own Property In Market City What You Should Know About Buying A Rent To Own Homes Sell My House Fast We Buy Houses

Taxes And Spending In Nebraska

Taxes And Spending In Nebraska

Dmv Fees By State Usa Manual Car Registration Calculator

Get Real About Property Taxes 2nd Edition

Taxes And Spending In Nebraska

50043 240th Street Council Bluffs Ia 51503 0000 House Exterior Inspired Homes House Styles

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price